May 21, 2024

With the exciting PIE (Portfolio Investment Entity) Tax days of April behind us, it seems like a good time to discuss what we do at Trustees Fund Administration for PIEs with their PIE Tax. Whilst there are several types of PIE funds, this article focuses on the daily priced “Exit filer option” of the Exit Multi-Rate PIEs (MRPs).

A Multi-Rate PIE attributes the total Taxable Income/Loss and Tax Credits down to each individual investor. PIE Tax is calculated for each investor based on their Prescribed Investor Rate (PIR) and the PIE then pays tax on behalf of the investors.

Investors elect their Prescribed Investor Rate (PIR) from the four currently available based on certain criteria. General rules for New Zealand Tax resident individuals: the PIR will be 10.5%, 17.5% or 28%, depending on all Income Amounts (not just PIE Income) over the past two years. Non-New Zealand Tax Residents will have a PIR of 28%. Companies, Incorporated Societies, Charities, Trusts, and Other PIEs may be able to use a 0% PIR, where they may then need to file their Tax return. Other PIEs would pass the Income/Credits through to the underlying investors. An investor's PIR is usually lower than their Income Tax rate, which can result in a lower tax amount.

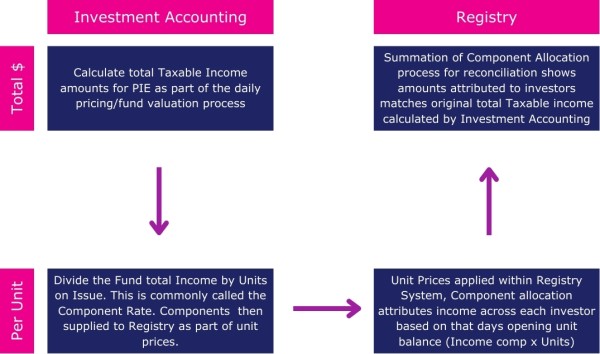

Throughout our Tax year (01 April to 31 March) the PIE's Total Taxable income and Tax credit amounts are calculated daily to be attributed fairly across all investors in the PIE. At Trustees Fund Administration, our Unit Pricing team within our Investment Accounting Department take these daily Totals, turns them to a per unit rate, and loads them into our system as part of our Registry Pricing process. These Totals are then attributed evenly across all investors in each PIE based on their Unit Holding on the day multiplied by the Income/Credit per unit rate received.

This daily component allocation process is added to the prior Year-to-Date Taxable Income/Loss and Credit balances. It fills up a tax liability Bucket* for each PIE where the investor has a balance. As there are different Tax rules for income from the various Investment types, the Taxable income amount on the PIE does not necessarily reflect the PIE's overall valuation gain or loss.

PIE Tax is triggered when an investor either makes a redemption or hits 31 March PIE Tax Attribution. The Tax calculation is the same for either event, using the Investor's PIR to calculate the Tax to be paid/refunded.

The standard basic tax calculation used is:

![]()

Where an account has a 0% PIR, the resulting tax amount is always $0.00.

Where an account has more than one owner, such as a Unit Trust Joint Account, the PIR used for the Tax calculation will be the highest of any owner on the account.

For redemptions during the year, the Tax payable amount is deducted as part of the transaction pricing process, with the amount net of tax paid to the investor/other party, and the Tax amount is sent to IR on behalf of the PIE. Similarly, where a Tax Refund is due, the Net redemption amount, including the Tax receivable, is paid to the investor/other party, and the Tax amount is then requested from IR.

The attribution process comes in at the end of the tax year and clears the rest of the outstanding Tax liability of all investors across each PIE. This step crystalises the remaining Tax amounts into unitised PIE Tax Payments or Refunds on each investor's account on 31 March, effectively emptying the bucket for the new tax year to start the process again.

Through April and May, we take care of everything else required to close out the PIE Tax for the prior year. Full-year reconciliations are completed for each PIE, ensuring all the Tax amounts are correct and aligned to the PIE Allocated amounts for the year and that IR reports also tie up to these totals.

There are three different IR reports to be filed in April and May for the end-of-year PIE Tax:

In parallel to all the Tax filing work, we work with our clients through this period to project manage the creation and distribution of Annual Statements to their members.

* Not an actual bucket.

** Foreign Tax credits can take an investor's tax liability to zero but cannot be used to get a Tax Refund.